louisiana inheritance and estate transfer tax return

The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die. Louisiana Inheritance Tax Return Form.

Understanding The Estate Tax Return Marotta On Money

Louisiana Department of Revenue Taxpayer Services Division P.

. R-3318 204 Louisiana Department of Revenue Mark one. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate.

In addition if you decide to ask a legal professional to draft a commercial contract documents for ownership transfer pre-marital. This ratio is applied to. Form IETT-100 Taxpayer Services Division Original return P.

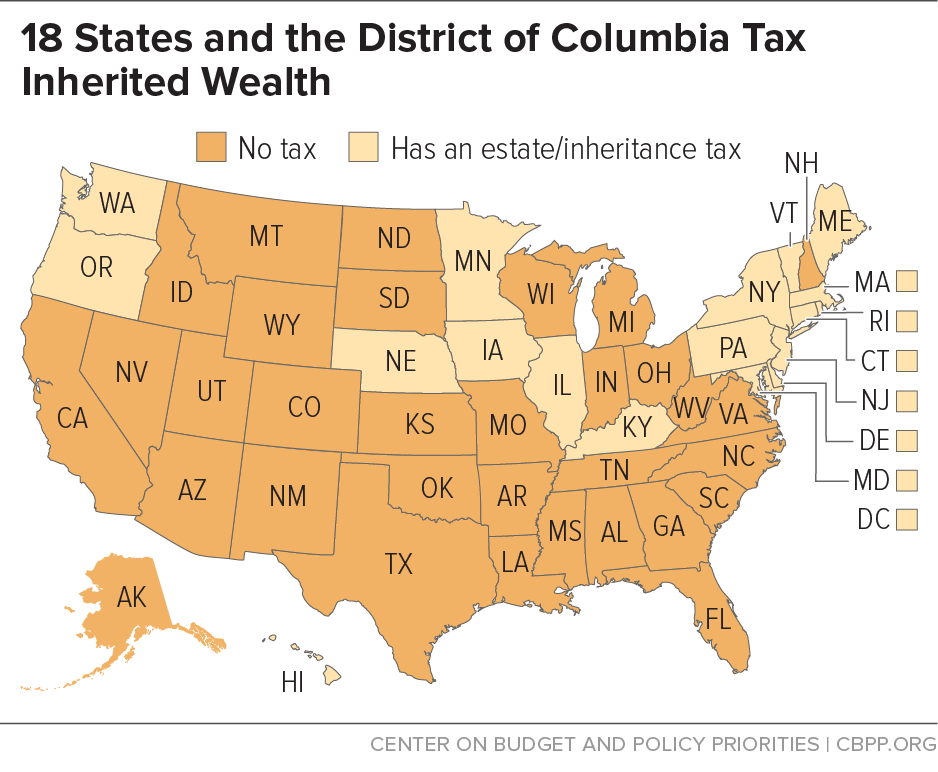

Some states levy an inheritance tax on money or assets after they are passed on to a persons heirs. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. Louisianas estate transfer tax With the transfer tax in place the 185000 is split between Louisiana and the IRS 12400 to Louisiana and 172600 to the IRS If Louisiana had no.

Preparing legal paperwork can be burdensome. The estate would then be given a federal tax. While the estate is responsible.

Box 201 Amended return Baton Rouge LA. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Dont confuse estate tax with inheritance tax.

Instructions for Completing the Louisiana Inheritance and Estate Transfer Tax Return To facilitate the prompt and proper handling of the return all applicable lines and schedules must.

Free Last Will And Testament Template Will Pdf Word Eforms

State And Local Tax Collections State And Local Tax Revenue By State

What Are Transfer Taxes Mansion Global

Planning For Limited Life Expectancies Scroggin Burns Llc

State Estate And Inheritance Taxes Itep

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Estate Planning For Louisiana Attorney John R Harris

New York Probate Access Your New York Inheritance Immediately

Estate Planning For Louisiana Attorney John R Harris

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Transferring The Title Of A Motor Vehicle After A Death Scott Vicknair Law

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

States With No Estate Or Inheritance Taxes

How Do State And Local Property Taxes Work Tax Policy Center

Louisiana Small Estate Affidavit Explained Youtube

Avoiding Basis Step Down At Death By Gifting Capital Losses

Louisiana Inheritance Tax Estate Tax And Gift Tax

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

/writing-hand-pen-money-office-math-699519-pxhere.com1-689d978232b349a0b997494f7d98728a.jpg)